Fabege is one of Sweden’s largest property companies. We own, develop and manage commercial properties in Stockholm.

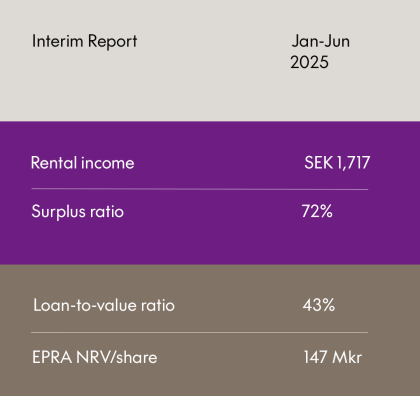

Read moreKey figures per June 2025

EPRA NRV/share

147 SEK

Net lettings

SEK -6m

Equity/assets ratio

45%

Loan-to-value ratio

43%

Surplus ratio

72%

Green financing

99%

More about us

Invest in Fabege

We have a clear strategy for our property portfolio, with a geographical focus on selected districts in high demand in the Stockholm area. Through good market knowledge, efficient property management with our own staff, a high level of service and flexibility and a stable financial position, we are able to create value for our owners and other stakeholders.

Read moreSubscribe

For information about our press releases and financial reports via e-mail, please use the form below.

Do you have a question?